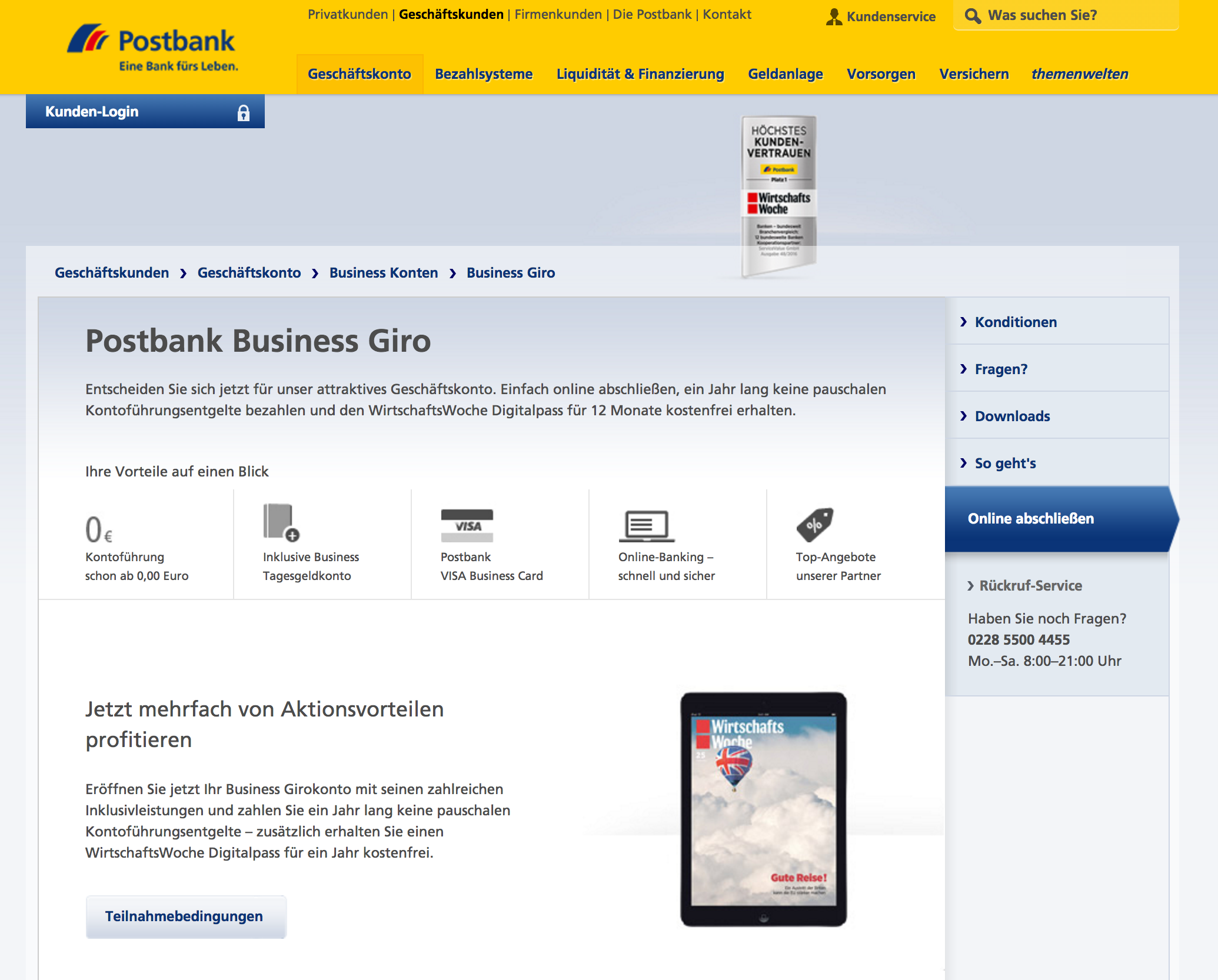

Postbank has a campaign about their “Business Giro” bank account and its tremendous benefits going and I wanted to add my two cents.

I am wondering which serious business owner would fall for Postbank’s ridiculous “benefits” they are listing on their website:

- 0€ Account Handling Fee: if your business isn’t able to pay 5€ or even 10€ per month you should close your business alltogether

- Call Money Account (Tagesgeld), when you click into the details they obviously want to hide, brings you 0,01% if you put in above 10.000€

-

VISA Business Card: what a

greatridiculous benefit when you do most of the shopping for your business online - Online Banking – secure and fast: I can’t believe they’re selling this as USP nowadays

- Top Deals from partners – you can spend your time reading Wirtschaftswoche which will extremely benefit your business </irony>

- nothing else…

The alternative(s)

N26

N26 might be broken: their revealed security glitches and inability to properly / easily transfer existing bank accounts from previous “Number 26 times” when they didn’t have a banking license don’t shine a bright light on them. They probably have lost a lot of private customers and surely don’t attract business customers with their handling. Still, they were the first, are kind of proven and still have a great service going.

Kontist

Kontist claims to have clever features to help small businesses, for ex. automatically transferring upcoming tax payments to a “separate account” so you don’t accidentally spend the money.

They also claim to give businesses a credit card without fuss – a problem currently experienced at the bigger banks (Deutsche Bank, Commerzbank, etc.)

Holvi

Holvi wants to do it all including an automatic invoicing service, featuring various apps (online store) to help your business grow, and, essentially providing you with a set of tools traditionally offered by online accountancy services.

In my opinion they are pretty solid when it comes to modern current accounts for businesses.

The Biggest Hurdle(s)

No matter if you choose a traditional bank or one of the hip new banking startups, it might be a trade-off between functionality and security. New banks seem only suitable for newly found businesses – a situation where you don’t need to tell all your business partners your new account details and switch all your already existing recurring payments. As a business owner for some time I would never put in the effort and potentially waste of time to switch.

At least, in Germany, banks are obliged to help you transfer your account. Good luck.

Image by John Jones @ toolstotal.com