Passive income is all the rage nowadays and I personally think “passive” in this respect is a little bit shortsighted when it comes to digital businesses. There is always something you need to do, maintain or keep running in order to profit from passive income, essentially you are actively involved in the process. An area where passive income is still kind of true is around financial investments with stocks and financial products returning dividends.

I have been investing in the stock market since Microsoft ($MSFT) released Windows 95 where I bought 9 shares shortly before. After several stock splits, investing in the dotcom boom (and riding it down again) then putting my money into Apple ($AAPL) right before the iPod was released I traded leveraged certificates for a year where I made good money, but … I needed to be actively involved. Since 2015 I am purely investing into ETFs that pay a dividend, effectively turning into a stream of passive income.

What is an ETF?

An exchange-traded fund (ETF) is an investment fund traded on stock exchanges, much like stocks. An ETF holds assets such as stocks, commodities, or bonds, and trades close to its net asset value. Most ETFs track an index, such as a stock index or bond index. ETFs may be attractive as investments because of their low costs, tax efficiency, and stock-like features. (Source: Wikipedia)

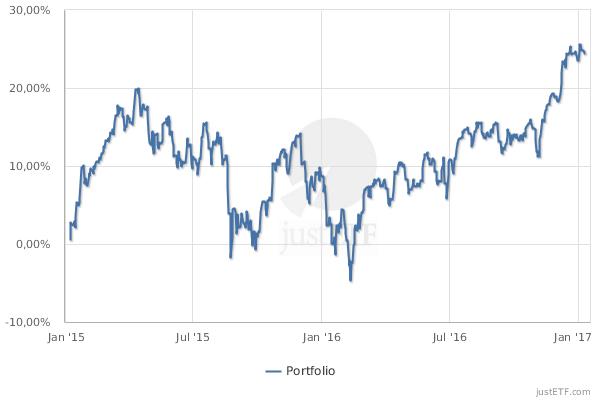

Current Portfolio

This post doesn’t represent any investment advice and is solely a description of my current portfolio and future plans.

| Name | ISIN | A/D | Region | Dividend |

|---|---|---|---|---|

| SPDR S&P Global Dividend Aristocrats UCITS ETF | IE00B9CQXS71 | D | Global | 3,57 % |

| SPDR S&P US Dividend Aristocrats ETF | IE00B6YX5D40 | D | USA | 1,75 % |

| LYXOR UCITS ETF S&P 500 D-EUR | LU0496786574 | D | USA | 1,87 % |

| DB X-TRACKERS STOXX GLOBAL SELECT DIVI | LU0292096186 | D | Global | 2,90 % |

| LYXOR UCITS ETF DOW JONES INDUSTRIAL | FR0007056841 | D | USA | 2,26 % |

| iShares DivDAX® UCITS ETF (DE) | DE0002635273 | D | Germany | 2,51 % |

| DB X-TRACKERS EURO STOXX® SELECT DIVI | LU0292095535 | D | Europe | 2,90 % |

| Schroder ISF Global Multi-Asset Income USD A Dis | LU0757359954 | D | Global | approx. 4-5% |

| iShares NASDAQ-100 (R) UCITS ETF (DE) | DE000A0F5UF5 | D | USA | 0,83 % |

| iShares Asia Pacific Dividend UCITS ETF | IE00B14X4T88 | D | Asia | 4,27 % |

| SPDR S&P Euro Dividend Aristocrats UCITS ETF | IE00B5M1WJ87 | D | Europe | 2,97 % |

How Should You Start!?

If you are just getting started most people would advise an ETF based on the MSCI World, representing shares from worldwide companies. If you are already familiar with ETFs I hope the list above provides you with inspiration on where to put your money and how much return you might potentially get. I always try to keep a healthy mix of stable dividend payers and more risky investments.

My Future Plans

Even though iShares NASDAQ-100 doesn’t pay a high dividend (<1%) it features interesting companies I like going forward: Apple (don’t like this one), Facebook, Amazon, Alphabet, Microsoft, Intel, etc. – as soon as I have available funds I will increase my position, as well as in iShares Asia Pacific Dividend in order to generate even more passive income.

Besides I am currently investigating if an investment into NVIDIA ($NVDA) makes sense as they are at the front of gaming and most importantly Car AI.